Auto Loan Tracker

Problem

Skills

- Wireframing

- UX/UI Design

- Prototyping

My Role

Solution

Impact

- 5MM in annual savings for customers using the tool

- 12% yearly reduction in calls related to remaining account balances

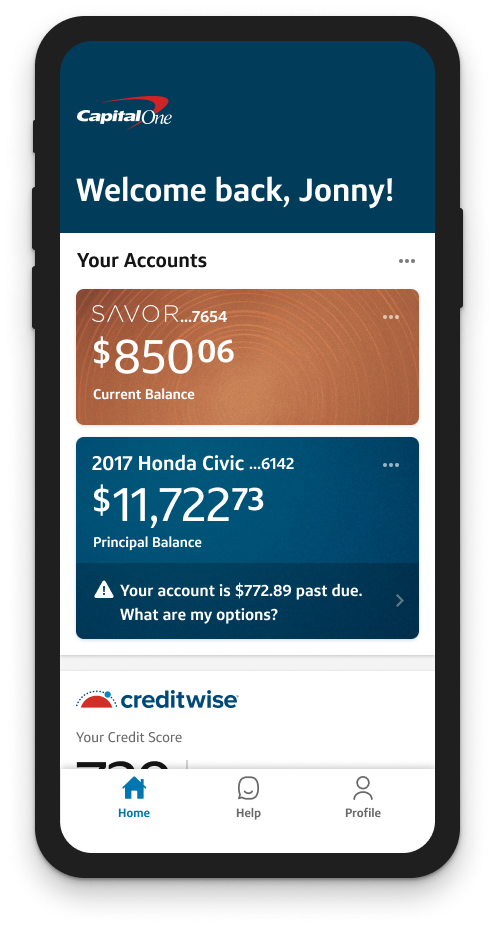

Auto Account Servicing

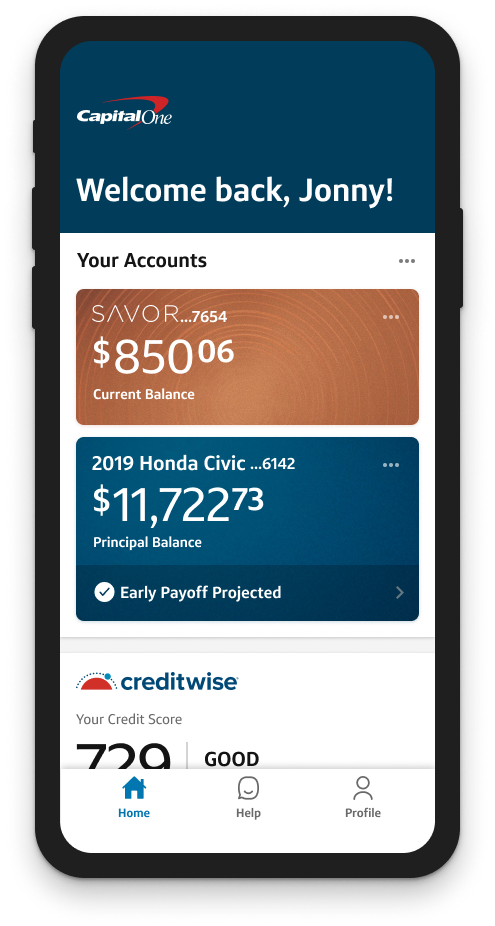

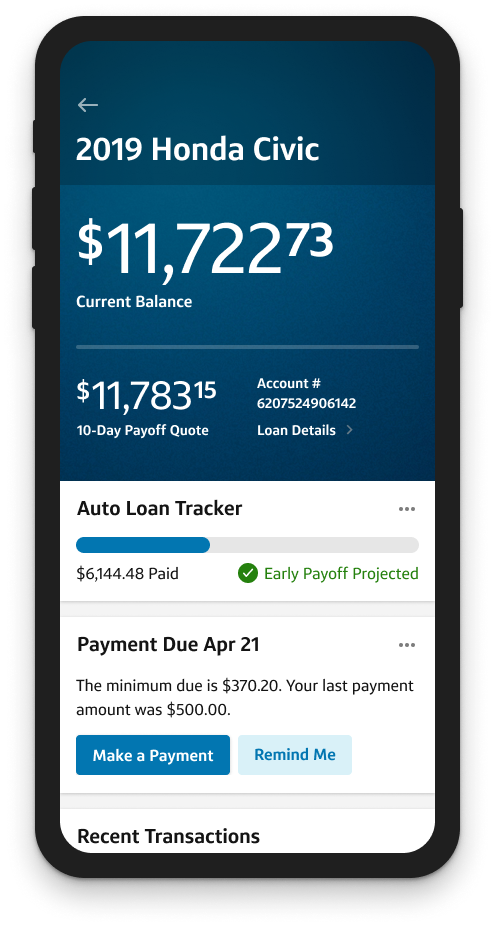

Homepage account tile design and account details view with Auto Loan Tracker feature.

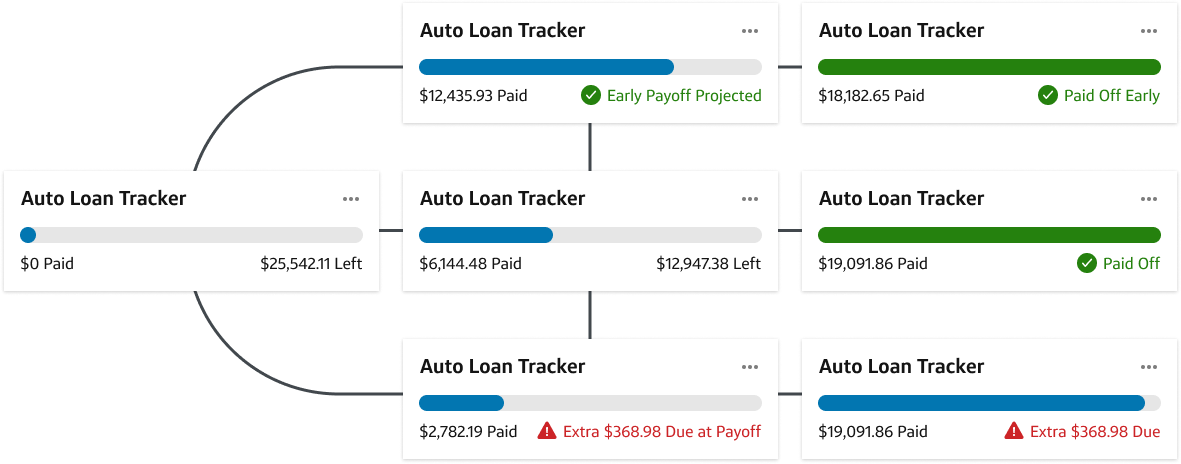

Auto Loan Tracker States

Possible Auto Loan Tracker states including New Loan, Default, Early Payoff Projected, Extra Due at Payoff, Paid Off, Paid Off Early, and Extra Due.

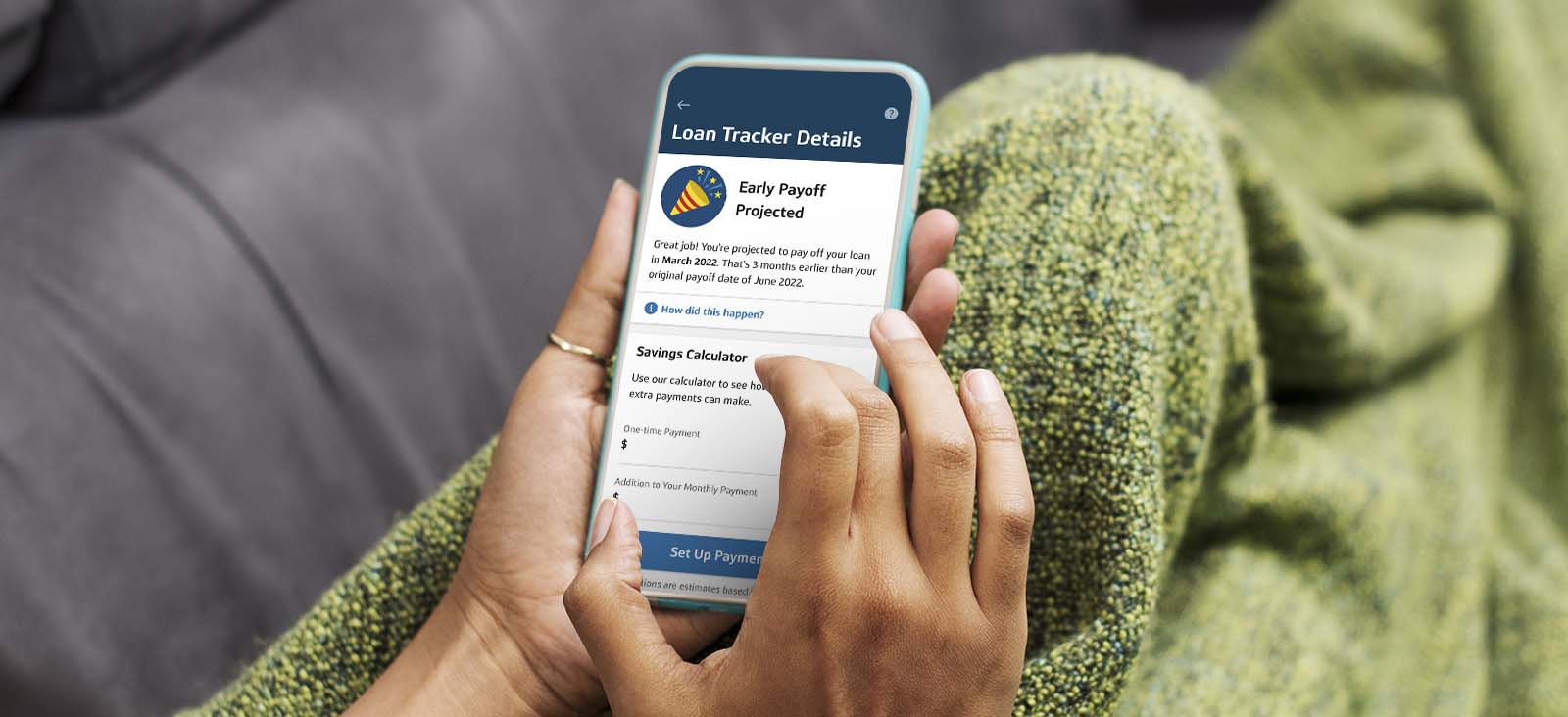

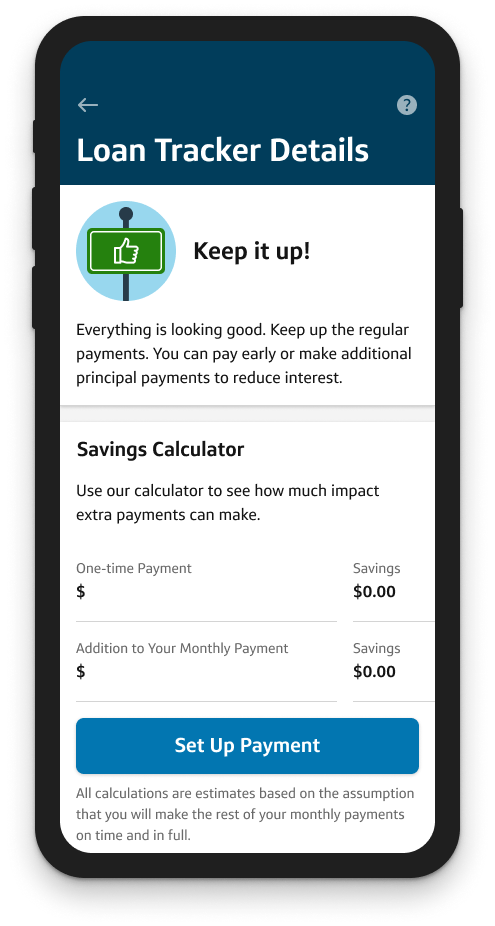

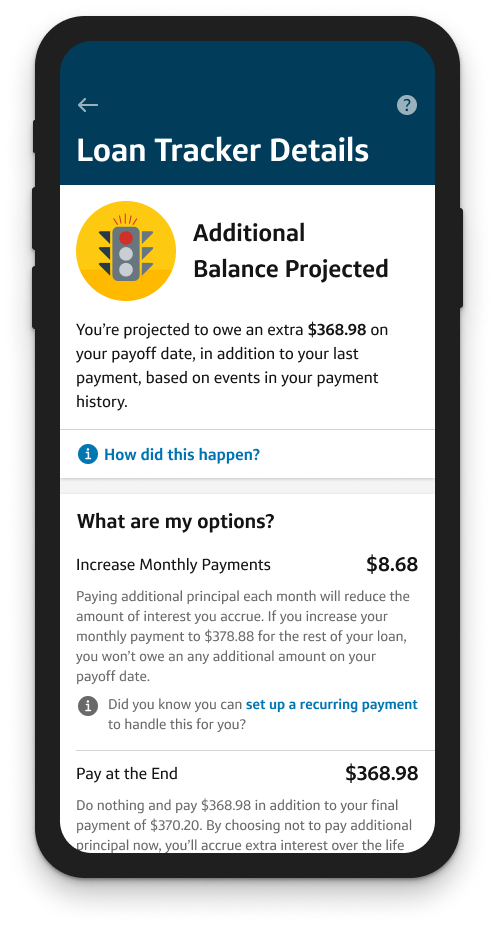

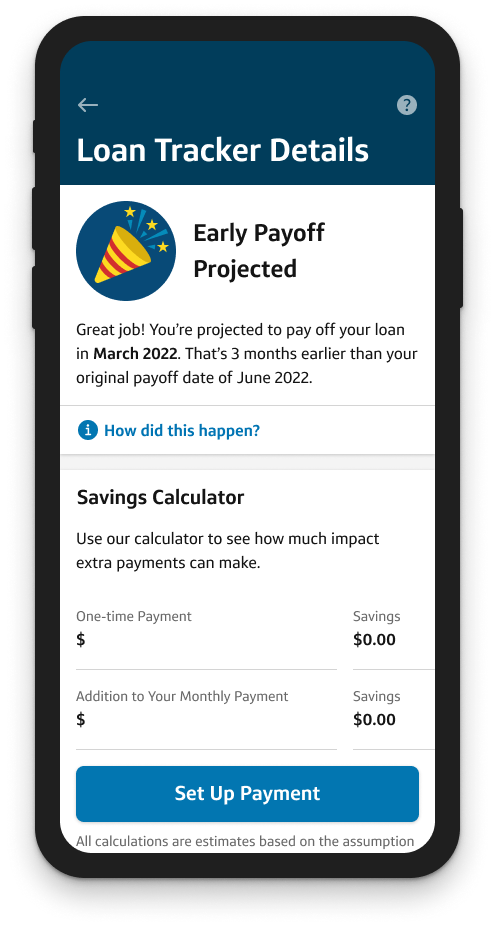

Loan Tracker Details

Possible Auto Loan Tracker detail states including Default, Early Payoff Projected, and Additional Balance Projected.

Get Current

Problem

Skills

- Wireframing

- UX/UI Design

- Prototyping

My Role

Solution

- We first conducted a series of empathy interviews to understand the choices customers made during financial hardship and why they made them.

- We then designed a digital self-service tool based, in part, on an existing repayment plan administered over the phone through call-center agents but with added flexibility to account for customer needs discovered during our interviews.

- This tool allowed customers to create a personalized payment plan and spread out their past due amount over a few months, getting current through manageable increments. Customers have additional configurable options including changing payment dates and adjusting payment amounts.

- Regarding the content throughout the experience, starting from a place of empathy in how the options were communicated resonated in early concept testing and was validated in subsequent call listening sessions after the tool launched.

Impact

- We saw a 30% increase in the use of our loan repayment plans once this was made available online.

- Customers who commit to a custom payment plan are twice as likely to get current on their loan.

- Over half of the customers using the tool online have been previously unreachable by phone despite numerous attempts.

- This feature freed up over an estimated 300 hours per week of collections agents’ time, allowing them to focus more on customers who prefer to speak over the phone.

- The launch of this feature resulted in over $8MM a year in loss reduction for the business.

- On average 800 more customers keep their cars every year using this tool, remaining Capital One customers and preventing the negative effects of collections and repossessions.

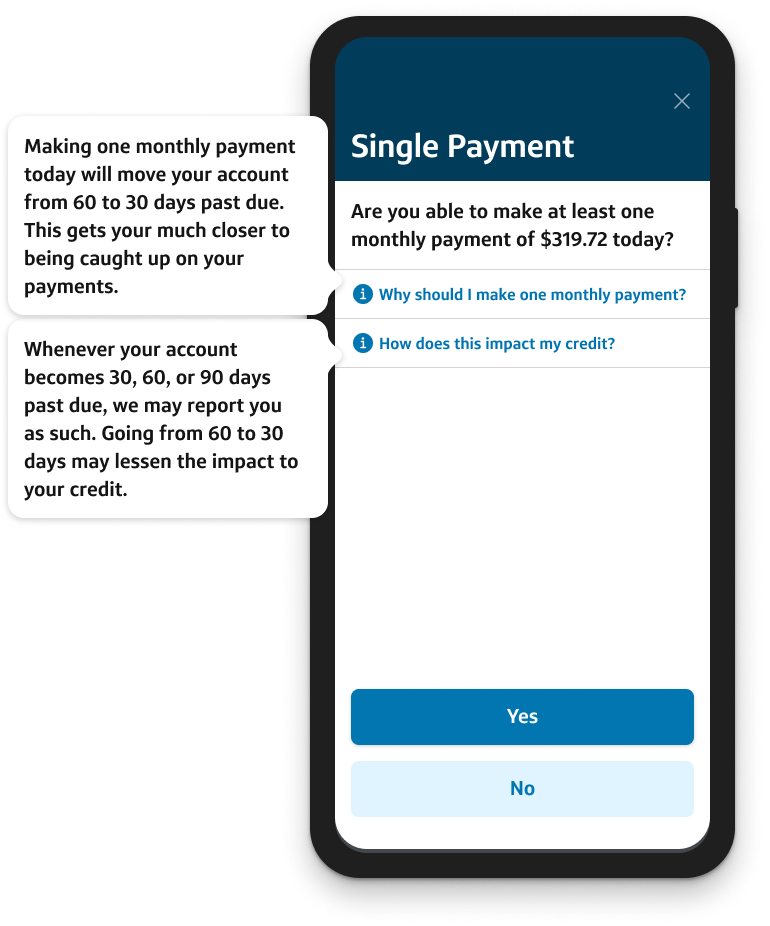

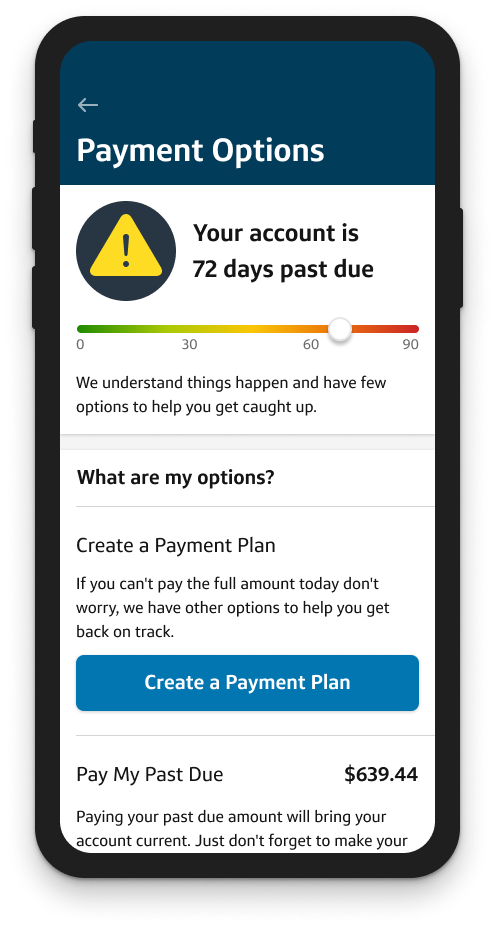

Past Due Account Status

Customer is informed at the highest accout level of the status of the account and the information that options are available. They are then presented with a detailed status view with multiple payment options to help them get back on track.

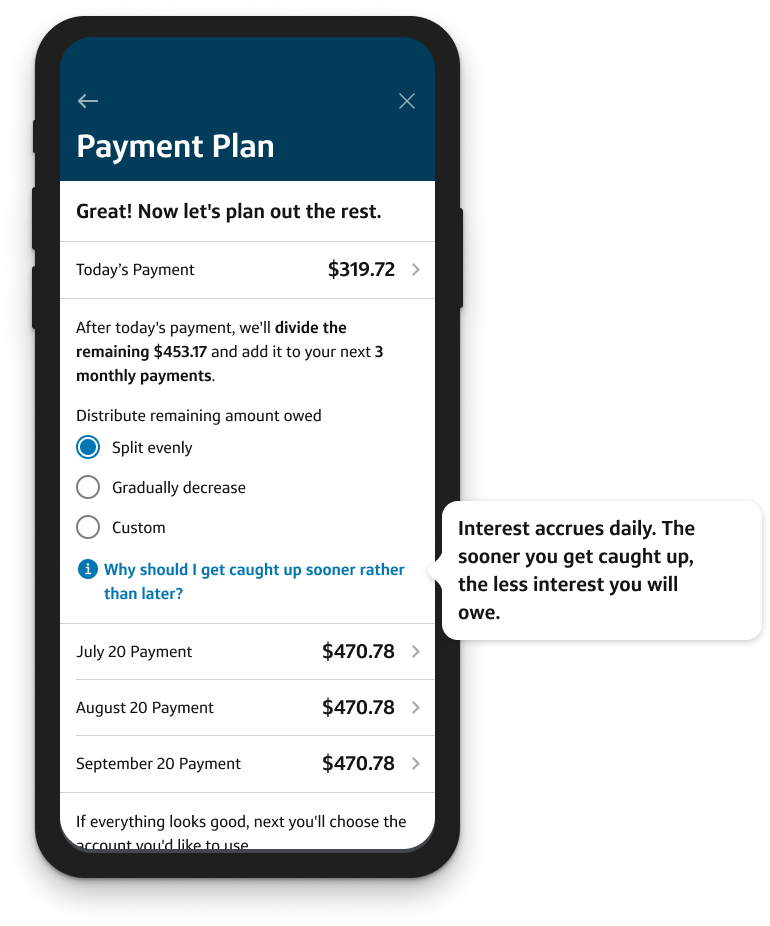

Creating A Payment Plan

After the user confirms the can make a payment that day, they then plan out the rest of their payments. The next step is to confirm a payment account and submit the plan. Additional context is provided to help inform customers as they progress.